Budget Alternatives

We can’t rebuild our economy by punishing low-income communities and people of color with unjust fines and fees. We need equitable alternatives.

The economic fallout from COVID-19 has put immense strain on state and local budgets — and the most significant impacts are landing on people living paycheck-to-paycheck and people of color.

Local and state governments should eliminate fees in the justice system and ensure that fines are equitably imposed and enforced. At a minimum, state and local governments should no longer attempt to balance budgets by assessing and collecting fines and fees from people who can least afford to pay them. Governments must rethink their current funding structures and adopt taxes or other innovative mechanisms to raise revenue that do not have regressive impacts on low-income communities and communities of color. The federal government should respond by incentivizing and providing financial resources to state and local governments that end their reliance on fines and fees to raise revenue and fill budget shortfalls.

In partnership with tax and budget experts: The Center for Budget and Policy Priorities, the Fines and Fees Justice Center will provide resources here for advocates and government officials looking to implement or advocate for alternative revenue raising options in their jurisdictions.

Budget Alernatives from The Center for Budget and Policy Priorities

The road to an equitable recovery starts with choosing progressive revenue sources.

COVID-19 has triggered a severe state budget crisis. State revenues are declining, costs are rising and millions of people are suddenly unemployed. What’s worse: official state revenue projections likely do not yet reflect the full extent of this pandemic’s impact on our economy.

How we choose to raise revenue now matters — not only for our short-term economic health, but for our long-term immunity to economic crises. We cannot repeat the same counterproductive policies of the Great Recession: budget cuts and increases in fines and fees. State and local governments need to choose progressive, antiracist revenue sources which protect the foundations of strong economies; promote equity and minimize cuts to public education, health care, and social services.

Here are 5 alternative revenue sources we can use to equitably rebuild our economy:

-

Fully and immediately draw from “rainy day” funds and other reserves.

Rainy day funds are designed to minimize cuts to public services and economic security programs on which people rely during the crisis. Health care, food assistance, and cash assistance help people keep their homes, stay healthy, and put food on the table.

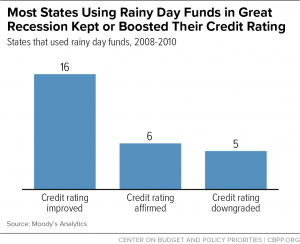

Drawing on rainy day funds now will help stave off deep cuts and minimize public-sector job losses — which will hit communities of color especially hard. While states generally put these funds to use, they don’t always draw them down as much as they should when the economy is in crisis. In some cases, this is due to short-sighted limitations on using the funds or requirements to replenish them when the economy is still weak from a prior recession. But as research shows — most state rainy day funds were at record highs when the pandemic hit; tapping them is unlikely to harm states’ bond ratings or ability to borrow.

-

Tax wealthy households and profitable corporations

Tax increases are typically a better option than tax cuts, especially when (1) they are done during economic downturns and (2) when they are focused on the highest-earners. Several states, for example, have considered or implemented a millionaire’s tax, which taxes people whose annual income exceeds $1 million, and helps form a more solid foundation for a state’s tax base.

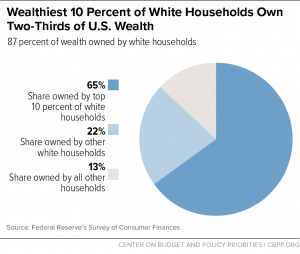

How much wealth a family has access to has been a significant determinant in how well they’ve fared during this pandemic. Wealthier families — who are disproportionately white — have been better positioned to avoid the severe health and economic impacts felt by low-income communities and communities of color. Adopting more progressive taxing of wealthy and high-income individuals can also help reverse a central injustice built into nearly all state and local tax codes: those with the most wealth pay the smallest share of their income.

Revenue from wealth taxes can also help pay for both crucial ongoing priorities, such as education, and new pandemic-driven needs, such as greater spending on healthcare and more assistance to help families make ends meet. States’ options include:

- Increasing taxes on the highest earners’ income;

- Increasing taxes on capital gains;

- Increasing taxes on owning, buying, and selling expensive homes, as well as expanding estate and inheritance taxes.

-

Repeal strict barriers to raise revenue at local level

Local governments provide and maintain crucial community services and functions: schools, parks, and basic necessities like clean water. Despite this, many localities face unnecessarily strict barriers to raising revenue, such as property tax limitations. These limits provide disproportionate savings to owners of more expensive homes, who are more likely to be white than Black or Latinx. Relaxing property tax limits could take pressure off local governments and bolster their COVID-19 responses.

-

Roll back economic development subsidies

Economic development tax breaks cost states a total of about $45 billion per year, despite evidence that they don’t meaningfully contribute to states’ economic growth. The benefits of these subsidies tend to flow up to shareholders (who are mainly wealthy and white), further entrenching socioeconomic and racial inequities. States should roll back these special breaks and redirect that savings toward responding to those families that are struggling to meet basic needs during this pandemic. Here are some proven ways to improve quality of life and build a healthy, sustainable economy:

- Make investments that raise the incomes of people living in poverty and reduce barriers raised by discrimination and bias

- Increase opportunities for a high-quality, affordable education.

-

Expanded sales tax base, couple with progressive tax credits (ie EITC and CTC)

One revenue option is increasing sales taxes. While this is a regressive tax, if the tax base is broadened and coupled with tax credits to supplement the regressivity of the tax, states can greatly benefit from this source of revenue. Low-income people pay much more of their income in sales taxes than higher-income people do because they must spend a very large share of their income to meet basic needs. Most states could improve their sales taxes and their tax systems in general with some expansion of the tax base to include services. Levying sales taxes on services makes state tax systems fairer, more stable, more economically neutral, and easier to administer. Moreover, because state sales taxes are a major source of funding for schools, universities, health care, public safety, and other functions of state and local government, adding services to state sales tax bases can help states maintain their support for those functions, for instance, during an economic downturn when state revenues are declining.

More resources from The Center on Budget and Policy Priorities (CBPP)

States need strong, stable finance built on sufficient tax revenues to support quality public services, vibrant local economies, and communities that promote equity now and in the future. Want to know which revenue-raising options are available in your state?

CBPP has launched a state-specific tool to help policymakers, advocates, and others better understand the various revenue-raising options available in their state as an alternative to more regressive policies like fines and fees. Explore which revenue-raising alternatives your state can choose with CBPP’s State Revenue Options Browser.