By Shanelle Johnson, FFJC Senior Policy Counsel

What does it mean to ask the question, can a person afford to pay the fines and fees assessed by the court? Many courts do not even ask the question before imposing fines and fees on an individual — and the few that do have almost no consistency in approach. Judges rarely ask the same questions or use the same framework when determining what amount is appropriate. Individuals who are assessed fines and fees often do not know what relief they are entitled to or how to comply with payment once fines and fees are assessed.

While our system of fines and fees needs a significant overhaul, everyday millions of people are sentenced to fines and fees around the country. For the first time, behavioral science — the science of how we make decisions or behave — is part of newly released tools that are attempting to guide the process of how courts assess fines and fees in a more thoughtful, methodical, uniform and effective way.

When individuals are assessed fines and fees they cannot afford to pay, the consequences can be crippling and destabilizing for families and communities. This is particularly true for poor people and communities of color who are over-represented in the legal system.

And at a time when most Americans’ finances are stretched due to inflation, and people struggle to recover from the effects of COVID-19, what affordability means is a constantly moving target. People are spending a greater percentage of their income on food, gas, and other necessities, leaving even less money to pay fines and fees than in what could be described as normal economic situations. According to the Federal Reserve, nearly 1 in 4 people in the U.S. will not be able to pay their monthly bills if faced with a new unexpected $400 expense, and 63% of Americans are living paycheck to paycheck.

Courts spend significant amounts to collect these debts, most of which are either uncollectible, not worth the cost to collect, or even more costly to collect than the generated revenue. A recent FFJC report uncovered at least $27 billion dollars of uncollected court debt nationally, though that number is just the tip of the iceberg.

Though many jurisdictions recognize the necessity of determining ability to pay, very few actually meet the minimum constitutional requirements for assessing fines and fees.

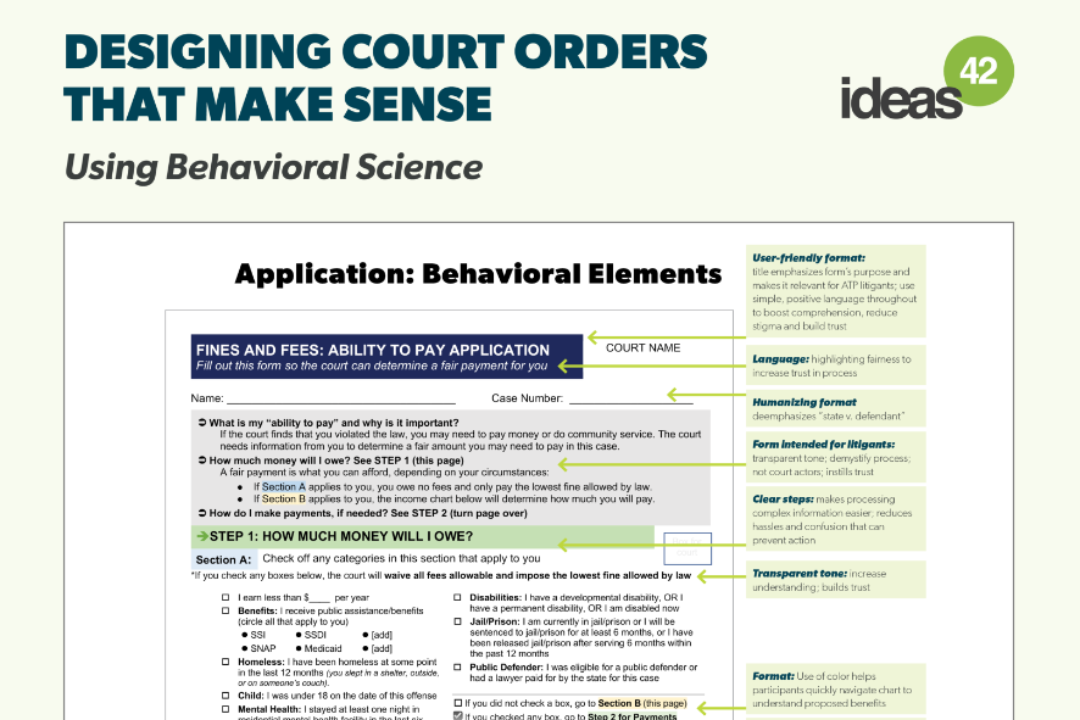

To help courts limit the excessive harms of fines and fees, FFJC and ideas42 collaborated to create universal ability-to-pay tools that can be used by any court seeking to assess more affordable fines and fees.

Combining behavioral science principles with FFJC’s policy guidance publication on ability-to-pay assessments, these tools are designed to increase understanding of the process, emphasize fairness and transparency, and reduce confusion – all of which help to increase likelihood of compliance with the court order. The language throughout is simple and straightforward, breaks the application and compliance process down into clear, easily understandable steps, and makes it easy for applicants to complete the form and for the court to review it.

While states and local jurisdictions continue to work toward more comprehensive legislative solutions – such as eliminating fees – the ability to pay application and court order can immediately be adapted to the specifics of any jurisdiction.

This year, there were hundreds of judicial elections across the nation. As newly elected judges take the bench, these tools help courts quickly and uniformly determine exactly how much a fine or fee should be reduced using guidelines from the United States Department of Housing and Urban Development. The transparent format provides relief for those unable to pay and equips people with information about what can be expected of them during and after these assessments are made — such as how much they will pay, how they make payments, what to do if they run into a hardship, and consequences for failing to take any action.

Learn more and about these game-changing tools — and if you have any questions or would like more information, please contact us at [email protected].