First-of-Its-Kind Report: How Much Criminal Justice Debt Does the U.S. Really Have?

Tip of the Iceberg: Extent of Nation’s Problem With Court Debt Unknown & Unknowable

A first-of-its-kind report released today by the Fines and Fees Justice Center uncovered national court debt totaling $27.6 billion — but that number is just the tip of the iceberg.

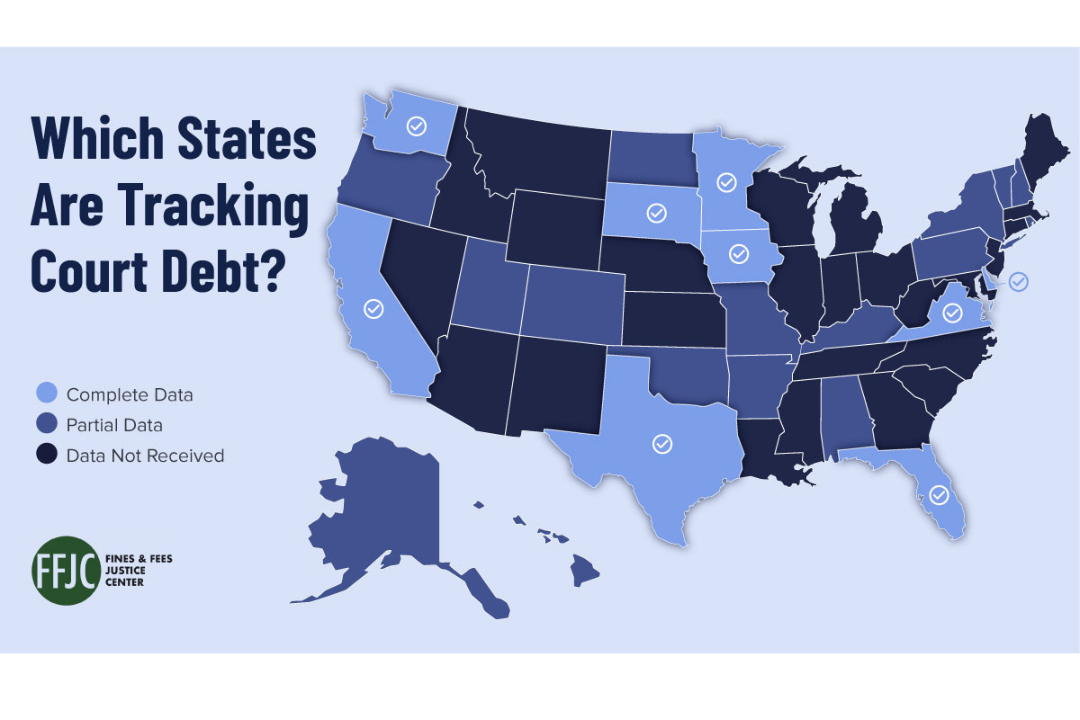

After two years of research and inquiries, only 14 states were able to provide information on the total amount of court debt owed to them, while an additional 11 states provided partial information. However, even the 14 states that provided complete data only did so for a limited range of years, making state-by-state comparisons difficult. Furthermore, the fines and fees imposed at conviction can be just a fraction of the total amount of unpaid fines and fees owed by people involved in the criminal legal system.

“It’s hard to solve this problem with so many missing pieces. No data means no accountability,” said Lisa Foster, co-director of the Fines and Fees Justice Center (FFJC). “The astonishing lack of data strongly suggests policymakers don’t have a basic understanding of how fines and fees affect their residents — or their bottom line.”

Millions of low-income people get trapped in the justice system simply because they can’t afford to pay fines and fees. In recent decades, state and local governments dramatically increased the number and amount of fines and fees imposed on people for everything from minor traffic violations to misdemeanors and felonies — and used draconian tactics to collect them. This regressive system of taxation is now entrenched in virtually every state, and in municipalities large and small across the country.

But over the past few years, many U.S. states and localities have enacted a wide range of fines and fees reforms. Last year, California enacted legislation that ended the collection of 23 fees charged to people in the criminal justice system — such as fees for public defenders, local booking fees, and probation and parole fees. This groundbreaking reform, championed by the Debt Free Justice coalition, also included $16 billion in debt forgiveness.

Understanding the extent of court debt would allow policymakers to accurately assess whether government resources are being wasted trying to collect debt that people will never be able to pay. A recent Brennan Center report found that the counties they studied spend 121 times what the IRS spends to collect taxes on fines and fees collection efforts. New Mexico’s largest county, Bernalillo, spends at least $1.17 for every dollar of fines and fees collected.

“Understanding the full scope of our nation’s criminal justice debt problem is vital to the task of creating an equitable justice system,” said Joanna Weiss, co-director of the Fines and Fees Justice Center. “With millions of people getting trapped in the justice system simply because they can’t afford to pay fines and fees, this is no time for policymakers to simply rearrange the deck chairs on the Titanic.”

While considerable research has uncovered the financial burdens and unintended consequences fines and fees have wreaked on individuals, Tip of the Iceberg is the first investigation into how much debt is outstanding or delinquent nationwide.

The report’s recommendations include:

- The total amount of fines and fees imposed, assessed, collected, and outstanding should be reported annually by a statewide agency in every state and D.C. The data should be made publicly available and should include debt owed to local/municipal courts, state courts, and county and city governments.

- All court fees, surcharges and costs should be eliminated. Fees (or surcharges) are extra costs that the government attaches to every conviction — even traffic tickets and minor infractions. Fees exist only to raise money for state and local governments. The justice system is supposed to serve everyone and should be paid for fairly and equitably by everyone.

- Fines and fees should be deemed uncollectible three years after they are imposed, and both public and private collections should cease. Attempting to collect this debt after three years is a waste of government resources and continues to harm low-income communities and communities of color.

- The number and amount of fines must be reduced. The tens of billions of dollars of outstanding debt demonstrate the staggering burden fines and fees place on low-income communities and communities of color. People cannot afford to pay the amounts imposed, and extracting this money from our most vulnerable communities has devastating consequences.

- State and local governments should legalize conduct that does not demonstrably harm public health and safety.

- Judges must be given discretion to waive or reduce fines. Each state should establish an ability-to-pay assessment based on FFJC’s Policy Guidance.

“If state and local governments don’t even know how much money they’re missing, are they really missing it?” said Briana Hammons, research and campaign associate at the Fines and Fees Justice Center and primary author of the report.

“When states and municipalities rely on fines and fees to generate revenue, it’s a lose-lose situation for both residents and their government. Attempting to collect debt from people who don’t have any money is like getting blood from a stone.”

Read and download the full report:

Tip of the Iceberg: How Much Criminal Justice Debt Does the U.S. Really Have?

For media inquiries, contact Jag Davies.